Canton Network DLT Interoperability Pilot For RWA Tokenization Is Complete

Milestone Date: March 12, 2024

A pilot involving Digital Asset Holdings, LLC and 45 institutions that tested the use of 22 different Distributed Ledger Technology (DLT) applications in capital markets on the Canton Network has been completed, and the results have been shared.

The pilot program showcased the potential of DLT through a variety of applications, including asset tokenization and fund registry, on the Canton Network TestNet. Participants from all market sides—15 asset managers, 13 banks, four custodians, three exchanges, and a financial market infrastructure provider—engaged in more than 350 simulated transactions that demonstrated real-time settlement and immediate reconciliation, all of which adhere to regulatory requirements for asset control, security, and data privacy.

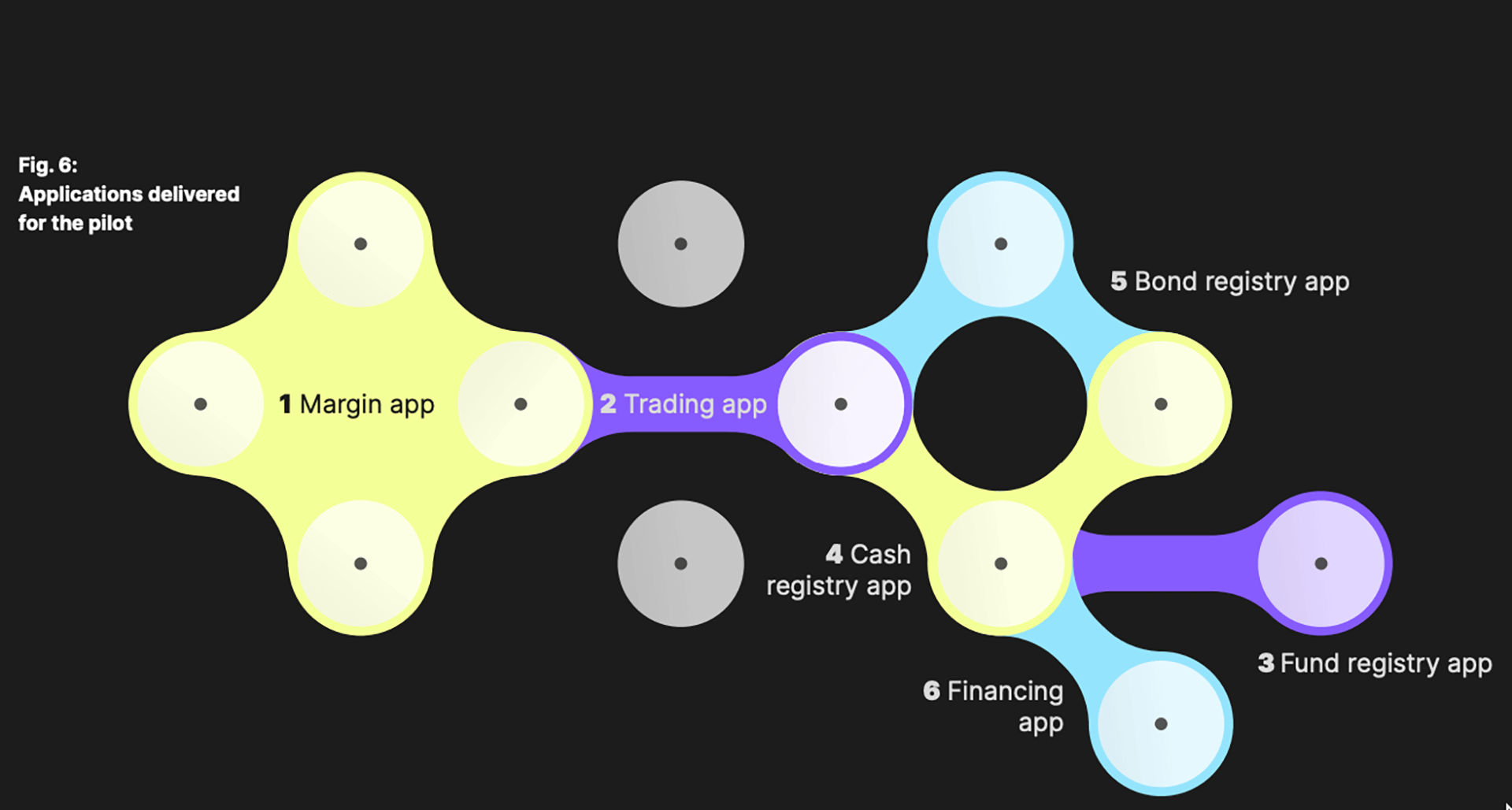

Over four days, the participants explored six decentralized applications (dApps); a margin app, a trading app, a fund registry app, a cash registry app, a bond registry app, and a financing app. For the traditional finance organizations that were involved in the pilot, this initiative highlighted the Canton Network's ability to streamline processes, reduce costs and risks, and ensure that the transfer and settlement of tokenized assets across 22 independently operated and permissioned blockchains met regulatory compliance.

The figure above, taken from a summary of the pilot’s findings that was published by Digital Asset Holdings, LLC, provides a high-level schematic of the six different dApps covered by the pilot.

“The pilot program marks an important milestone for the Canton Network,” said Yuval Rooz, CEO and Co-Founder of Digital Asset Holdings. “Canton allows previously siloed financial systems to connect and synchronize in previously impossible ways while abiding by the current regulatory guardrails. We’re proud to facilitate the pilot and look forward to working with the pilot participants to continue identifying additional use cases where the Canton Network can be leveraged.”

Throughout the program, institutions with active blockchain applications — such as BNY Mellon, Broadridge, DRW, EquiLend, Goldman Sachs, Oliver Wyman, and Paxos — supplied the working group with market insights and expertise.

Other participants included abrdn, Baymarkets, BNP Paribas, BOK Financial, Cboe Global Markets, Commerzbank, DTCC, Fiùtur, Generali Investments, Harvest Fund Management, IEX, Nomura, Northern Trust, Pirum, Standard Chartered, State Street, Visa, and Wellington Management. Deloitte acted as an observer, and Microsoft as a supporting partner.

By Elizabeth Morrison

Published:April 1, 2024

Sources

News

News

Social Media ( including podcasts)

Digital Asset Holdings, LLC